To lower the burden of taxpayers in our country and to encourage more and more people to pay taxes the government has come with the Income-tax faceless e-assessment scheme. Under this article, we will share with you all the details about the income tax faceless e-assessment scheme. All the benefits, feature as announced by the Finance Minister is mentioned in this article. Also, we will tell you all about the Income Tax Faceless e-Assessment scheme with thorough and true knowledge for the year 2020.

Table of Contents

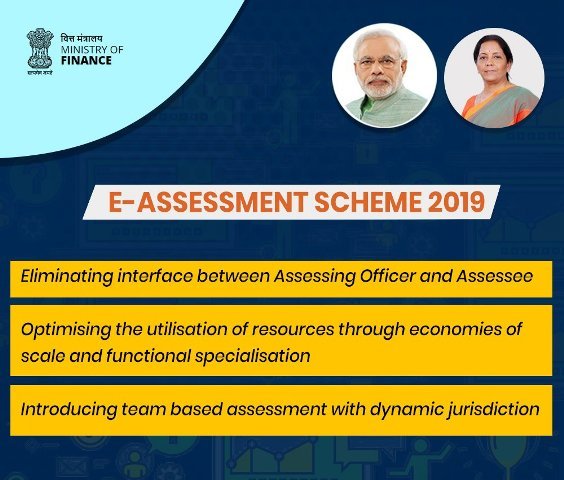

Income Tax Faceless e-Assessment Scheme

The finance ministry has notified that the faceless e-assessment scheme for the year 2019 and 2020 is undertaken for conducting faceless scrutiny assessment of income tax returns (ITR). The scheme involves the creation of e-assessment centers at national and regional levels and also auto-allocation of cases among these centers. As announced by the finance minister, it is said that the faceless e-assessment scheme is undertaken so that the income taxpayers have not to be present in the income tax office to pay the tax rather they can do it by sitting at home.

Features Of The Scheme

The certain features under the Income Tax faceless e-assessment are given below:-

- Under the scheme, the scrutiny notice will be issued to the individual under section 143(2) if he has under-reported his income or overstated losses.

- The individual will have to reply within 15 days from the date of receipt of the notice.

- The notice issued will be sent electronically on the taxpayer’s account on the e-fling website, to the registered email address of the taxpayer or on the mobile app of the income tax department.

- An individual will be required to respond to the notice or order received through the registered account only.

- The response shall be considered successfully submitted once an individual has received the acknowledgment from the National e-assessment Centre.

- Individual taxpayers would not be required to appear either personally or through an authorized representative in relation to the proceedings related to the scheme before income tax authority.

- All the communication between the department and the taxpayer would be done electronically.

- The e-assessment scheme will be fully automated.

Central Government Scheme

Benefits Of The Scheme

There are many benefits of the income tax faceless e-assessment scheme for the year 2019 and 2020

- The first and foremost benefit of the scheme is that the income taxpayer would not be bond to present at the income tax office.

- All the notice and the receipt will be sent to the payer in electronic form.

- The taxpayer will be at ease through this scheme.

- The scheme will encourage more and more people to pay the tax.

- In the union budget for the year 2019 and 2020, a separate budget has been allocated for this scheme.

- The process to pay the tax will be fully automatic.

Officer Deputed For the Scheme

A total of 2,686 officials of the IT department have been deputed for implementation of the Income Tax faceless e-assessment scheme. Also, in the first phase, the tax department has selected 58,322 cases for scrutiny under the faceless e-assessment scheme for the year 2019-2020.