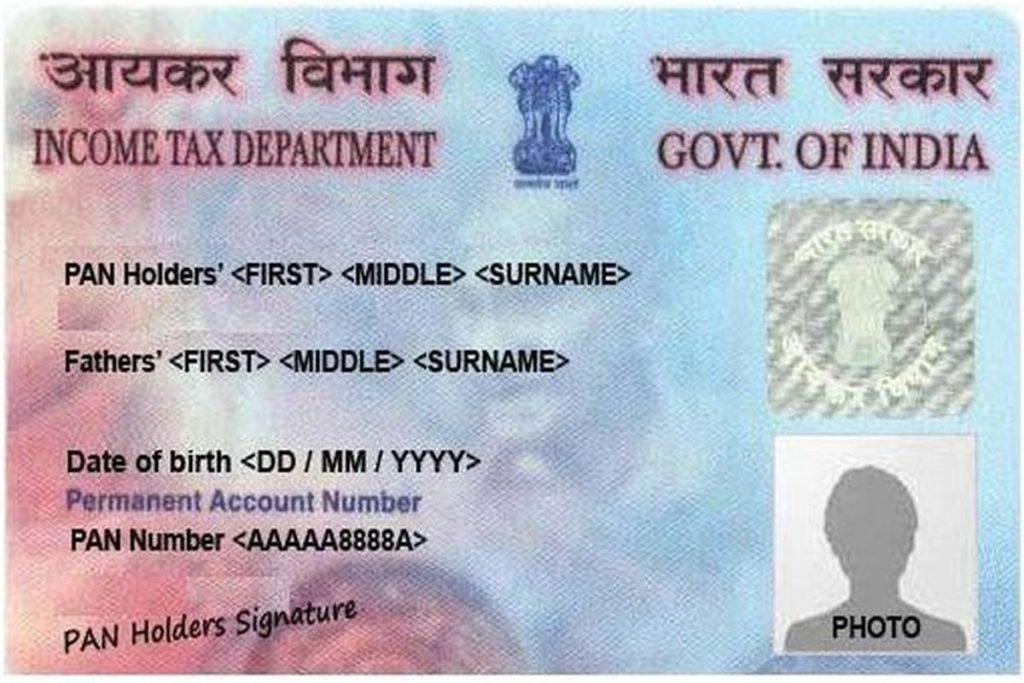

PAN Card is a very important document issued by the income tax department. Do you need a PAN Card (Permanent Account Number)? If yes, then we have very valuable information for you. Now pan card can be issued as e-pan. The income tax department has started taking online application form to provide Instant e-Pan Card. To grab the detailed information about instant electonic pan card using Aadhaar Card you have to read this article by scroll this page till the endpoint.

Table of Contents

Update Under Instant E Pan Card

Revenue Secretary Ajay Bhushan Pandey has announced to launch a system under which Permanent Account Number shall be instantly allotted online during the budget announcement for the year 2022. To apply for the Instant E pan card applicants need not fill the lengthy application, now you need to seek online application via www.incometaxindiaefiling.gov.in portal. Those applicants who already have PAN card have to link Aadhaar card with it. Further, furnished information will help you in doing so.

Instant e-Pan Card

Pan Card is a photo ID proof issued by the income tax department. Department has started issuing E Pan Card. Now you can seek application to have an e-pan card and grab it very easily and quickly. To Apply For The PAN Card, you have to follow a few easy steps as mentioned in this article. Go to the official website and seek online application. Those applicants who already have pan card can not apply for the pan card. This facility is not for HUF, Firms, Trusts and Companies. Applicants must have aadhaar card and active mobile number.

Highlights Of Instant E Pan Card

| Issued by | Income Tax Department |

| Article about | Instant E Pan Card |

| Announced by | Revenue Secretary Ajay Bhushan Pandey |

| Launched on | Very soon |

| Launched for | People of the country |

| Category | Central Government Initiative |

| Last date of linking Aadhaar | – |

| Mode of application | Online |

| Official website | https://www.incometaxindiaefiling.gov.in/home |

Eligibility Criteria

- Applicant must have pan card

- Applicant must be an Indian citizen

- Applicant must not have PAN card already

Benefits of Instant E Pan Card

- Applicants will get permanent account number card instantly

- Process of application is less time consuming and hassle-free

- The easy application submission process

- Applicants need not pay an application processing fee

Procedure to Apply for Instant e-Pan Card

Follow the below-given steps to apply for the instant PAN :

- To apply for the instant e pan card you need to seek online application by visiting the official website of the Income Tax Department.

- From the home page of the website go to the quick link section and search instant e pan card option

- Read the instructions carefully and click “Apply Instant E-Pan Card” option

- Click “next” option for Aadhaar e-KYC process.

- The online application form will appear on the screen

- Enter all the details in the application as asked on the screen (as per your aadhaar card).

- Upload the image and signature in JPEG format

- Submit the application form by click submit option after reviewing the details.

- 15-digit acknowledgement number will be sent to your mobile number and email id.

Check e-pan card status and download

- To check the status and download e-pan card go to the official website.

- Enter the acknowledgement number along with captcha code appears on the screen

- Click submit option and check the status of your E pan card

- Click the download option to download the electronic pan card.

Procedure to Link Aadhaar Card with PAN Card:

Appliers who already have PAN Card have to link his/ her Aadhaar card with it. Here are some steps which you need to follow to link your PAN with Aadhaar mentioned further:

- Browse the official website of the Income-tax department

- Go to the quick link section given left-hand side of the home page

- Click “Link Aadhaar” option from there

- Enter PAN, Aadhaar Number and name as per Aadhaar

- Enter Captcha code shows on the screen

- Click “Link Aadhaar” option and enter OTP you received

Important links

Note: You may read the article in detail to grab all the necessary information.