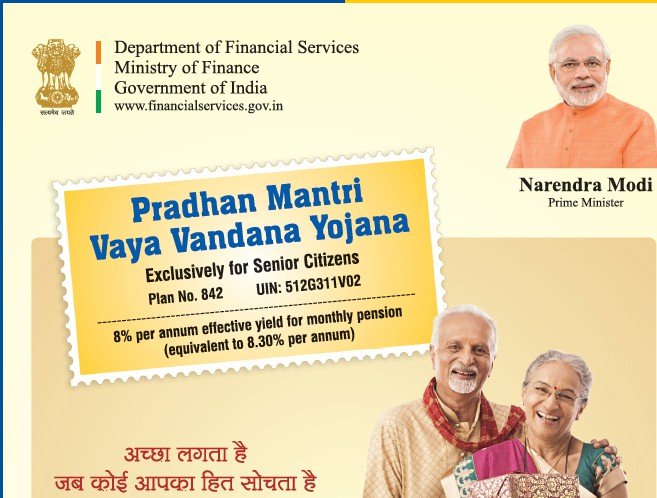

Pradhan Mantri Vaya Vandana Yojana Online| Form| PMVVY Scheme| पीएम वय वंदना योजना| प्रधानमंत्री वय वंदना योजना

Pradhan Mantri Vaya Vandana Scheme has started by the central government for providing benefits like pensions to the senior citizen of the country. Under the PMVVY Scheme Life Insurance LIC provides an assured return of 8% per annum for 10 years. The scheme was launched in the Budget Speech of the financial year 2018-19. The eligible senior citizens of the country may invest the capital money under Vaya Vandana till 31st December 2020. The minimum amount of purchase is Rs. 1, 50,000/- and the maximum purchase price is Rs. 15, 00,000/-

Table of Contents

LIC Vaya Vandana Scheme

Under the Pradhan Mantri Vaya Vandana Yojana once you have to purchase the policy. After the maturity of the policy (10 years later from the date of purchasing policy) the LIC will pay you Purchase price and 8 % interest rate per annum of ten years time period. The objective of the Pradhan Mantri Vaya Vandana Scheme is to secure the future of citizens after their retirements. The complete details of the purchase price, interest rates and time duration are in the form of chart is given in just below section.

Atal Pension Yojana

Vaya Vandana Scheme Withdrawal Period

The first installment of the pension scheme can be withdrawn after a period of 1 year, six months, 3 months, or 1 month as per the premium plan taken. Willings applicants from the country who wants to take the benefits of the scheme can apply through any of the online or or offline mode. For Online mode, you have to go to the official website of the LIC and then apply there. For offline mode, you have to go to the nearest LIC office, take the application form, attach the property documents and submit it to the concerned officer.

Brief Summary Of PMMVY

| Scheme name | Vaya Vandana Scheme |

| Launched date | financial year 2018-19 |

| Ministry | Ministry of Finance |

| Start date to apply | Available now |

| Last date to apply | 31st march 2020 |

| Objective | To secure the future of citizens after retirement |

| Category | Central govt. Scheme |

| Official website | https://www.licindia.in/ |

Pradhan Mantri Mandhan Yojana

About PMVVY 2020

The PMVVY scheme provides old age income security to senior citizens of the country. In the Pradhan Mantri Vaya Vandana Scheme government gives the guarantee of assured pension/return linked to the subscription amount. LIC Vaya Vandana provides an assured return of 8% per annum for 10 years. The interest under the scheme is provided on a monthly, quarterly, half-yearly and yearly basis.

Key Features Of Vaya Vandana Features

- Maximum limit PMVVY is Rs. 15 lakhs per senior citizen.

- LIC of India is operating this scheme.

- The assured interest of 8 % per annum on the purchase price.

- Time duration of the scheme is 10 years.

- The first instalment of pension shall be paid after yearly, half-yearly, quarterly or monthly respectively depend upon the mode of the scheme.

- The pension payment shall be through NEFT or Aadhaar Enabled Payment System.

- Scheme also provides the relief in Tax.

Mode Interest Rate Vaya Vandana Scheme

| Mode of Pension | Minimum Purchase Price | Maximum Purchase Price | Pension Interest rate (p.a) | Pension amount |

| Yearly | Rs. 1,44,578/- | Rs. 14,45,783/- | 8.3 % | 12,000 |

| Half-yearly | Rs. 1,47,601/- | Rs. 14,76,015/- | 8.13 % | 6,000 |

| Quarterly | Rs. 1,47,601/- | Rs. 14,90,683/- | 8.50 % | 3,000 |

| Monthly | Rs. 1,50,000/- | Rs. 15,00,000/- | 8.00 % | 1,000 |

Benefits Of PM Vaya Vandana Scheme

Pension Payment

- On survival of the Pensioner during the policy term of 10 years, pension in arrears (at the end of each period as per mode chosen) shall be payable.

Death Benefit

- On the death of the Pensioner during the policy term of 10 years, the Purchase Price shall be refunded to the beneficiary.

Maturity Benefit

- On survival of the pensioner to the end of the policy term of 10 years, Purchase price along with final pension installment shall be payable.

Loan

- Loan facility is available after completion of 3 policy years. The maximum loan that can be granted shall be 75% of the Purchase Price.

- The rate of interest to be charged for loan amount shall be determined at periodic intervals

Eligibility for PMMVY

- The applicant must be a permanent resident of India.

- The minimum age limit is 60 years.

- There is no upper age limit.

Important Documents

- Aadhaar Card

- Pan Card

- Age Certificate

- Income Certificate

- Residence Certificate

- Bank Account Details

- Mobile Number

- Passport Size Photograph

How To Apply For Pradhan Mantri Vaya Vandana

- The interested candidates who want to apply for Pradhan Mantri Vaya Vandana go to the official website of LIC.

- You can also contact their nearest LIC Branch for the offline application mode.

- We are also providing you the direct links in just below section.

- Click on the buy online section and provide all the required detail.

- Click on the submit button

Offline Application Procedure

- First of all, go to the nearest LIC Office.

- Provide all the related information to the agent.

- Show your concerning documents to the LIC agent.

- The agent will register you in the yojana.

- After the verification of documents, the agent will start the policy of this Yojana.

Important Download

| Pmvvy PIB Notification | Click Here |

| PMVVY User Manual | Click Here |

Quick Links

| PMVVY Buy online | Click Here |

| Official website | Click Here |

| Central govt. scheme | Click Here |