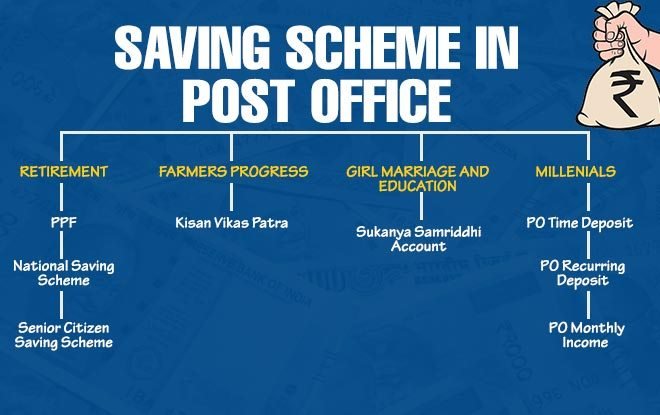

Post Office Saving Scheme provides a number of the money-saving schemes in each and every branch of the post office in the country. Under the Post Office saving Scheme Government of India provides PPF, NSC, FD, RD, MIS, TD, KVP, and SCSS Type of scheme in each Post office. Today we will discuss here Post Office Saving Scheme Interest Rate & Tax Benefits. Post Office Saving Schemes are easy to invest. You easily enroll under the schemes. All schemes are risk-free because these all are regulated by the government.

Post Office Saving Scheme In our country, every person is trying to get a better future & better Survival options in their life and for fulfilling this dream they start a number of Saving Schemes. Today Here we are providing you Latest Post Office Saving Scheme Details. The objective of these all schemes is to provide better Money Saving Options with different interest rates.

Detail of Post Office PPF, NSC, FD, RD, MIS Today we are here to provide you all detail about all Post Office Saving Scheme . You will get here about all saving schemes Interest Rate, benefits, eligibility, minimum amount & Tax Benefits, etc. this scheme will be available In all post offices of the country. You may easily visit their regional post offices for opening any saving scheme.

Types of Post Office Saving Scheme Year Post Office Recurring Deposit Account (RD) Post Office Time Deposit Account (TD) Post Office Monthly Income Scheme Account (MIS) Senior Citizen Savings Scheme (SCSS) 15 year Public Provident Fund Account (PPF) National Savings Certificates (NSC) Kisan Vikas Patra (KVP) Sukanya Samriddhi Benefits of Post Office Saving Scheme There are following benefits of the scheme- Easy to access. Better option of saving your future. Risk free. Have a better interest rate & Tax benefits. Easy to invest. There are following document required of the scheme- Aadhar Card Pan Card Address Proof KYC Form Minimum Amount For Opening Account name Minimum amount required to open account

Savings account (Cheque account)

Rs. 20

Savings account (non Cheque account)

Rs. 20

Monthly Income Scheme (MIS)

Rs. 1,500

Fixed Deposit (FD) Account

Rs. 200

Public Provident Fund (PPF)

Rs. 500

Senior Citizen Savings Scheme (SCSS)

Rs. 1,000

Interest Rate

Post Office Savings Scheme Name

Interest Rate for 1 January to 31 March 2019

Rate of Interest for 1 April to 30 June 2019

Interest Rate for 1 July to 30 September 2019

Interest Rate for 1 October to 31 December 2019

Compounding Frequency

Description about Post Office Scheme

Savings Deposit Scheme Account

4.0

4.0

4.0

4.0

Annually

Post Office Savings Bank Account (PO-SB) Details

1 Year Time Deposit

7.0

7.0

6.9

6.9

Quarterly

PO Fixed / Time Deposit Account (TD) Details

2 Year Time Deposit

7.0

7.0

6.9

6.9

Quarterly

3 Year Time Deposit

7.0

7.0

6.9

6.9

Quarterly

5 Year Time Deposit

7.8

7.8

7.7

7.7

Quarterly

Recurring Deposit (5 years)

7.3

7.3

7.2

7.2

Quarterly

PO Recurring Deposit Account (RD) Details

Senior Citizen Savings Scheme (5 years)

8.7

8.7

8.6

8.6

Quarterly & Paid

SCSS Account Details

Monthly Income Scheme Account (5 years)

7.7

7.7

7.6

7.6

Monthly & Paid

PO Monthly Income Scheme (MIS) Account Details

National Savings Certificate (5 years)

8.0

8.0

7.9

7.9

Annually

NSC Account Details

Public Provident Fund Scheme

8.0

8.0

7.9

7.9

Annually

PPF Account Details

Kisan Vikas Patra

7.7

7.7 (Maturity at 112 months)

7.6 (Maturity at 113 months)

7.6

Annually

KVP Account Details

Sukanya Samriddhi Account Scheme

8.5

8.5

8.4

8.4

Annually

SSA Account Details

Post Office Saving Scheme Tax Benefits Scheme Tax Implications Post Office Savings Account

Tax free Interest upto Rs 10000 from the financial year 2012-13

5-Year Post Office Recurring Deposit Account

Tax benefit upto 5 years under section 80 C on deposits

Post Office Time Deposit Account (TD)

Tax benefit upto 5 years under section 80 C on deposits

Post Office Monthly Income Scheme Account (MIS)

Interest earned is Taxable & No deduction under Sec 80C for

Deposits made.

Senior Citizen Savings Scheme (SCSS)

– Tax rebate under section 80 C for deposits

– TDS to be deducted on interest earned for more than Rs

10000 pa

15 year Public Provident Fund Account (PPF)

Tax rebate under section 80 C for deposits (maximum Rs 1.5 lacs pa

National Savings Certificates (NSC)

Tax rebate under section 80 C for deposits (maximum Rs 1.5 lacs pa

Kisan Vikas Patra (KVP)

Interest is taxable but no tax on amount received on maturity

Sukanya Samriddhi Accounts

Investment (upto Rs 1,5 lacs exempt under Section 80C), interest and

Amount received on maturity is tax free

Eligibility For Post Office Saving Scheme Scheme Eligibility

Post Office Savings Account

Resident Indian , Minor and Majors

5-Year Post Office Recurring Deposit Account

Individual

Post Office Time Deposit Account (TD)

Individual

Post Office Monthly Income Scheme Account (MIS)

Individual

Senior Citizen Savings Scheme (SCSS)

Individual of age> 60 years or age >55 years who have opted for

VRS or Superannuation

15 year Public Provident Fund Account (PPF)

Individual

National Savings Certificates (NSC)

Individual

Kisan Vikas Patra (KVP)

Individual (Adult)

Sukanya Samriddhi Accounts

Girl Child – Upto 10 years from birth and 1 additional year of grace

How To Apply For Post Office Saving Schemes Any eligible candidate with all required documents may easily apply for Post Office Saving Scheme . Please visit your regional post office to open any above mentioned Post Office Saving Scheme. Submit your all required document with KYC form in the post office where you want to open your saving scheme You also visit the official website of the Post office for more queries. Important Download Quick Links